Page 13 - Market Analysis Report of Optical Communications Field in China & Global market 2022

P. 13

CICT

optical

communication

items products in

The group of three

ZTT

ZTE

HTGD

SDGI

ETERN

Company

FUTONG

ZHONGLI

Tongguang

optical

communication

HUAWEI

The group of two

items products in

5

4

9

1

3

6

7

8

10

Ranking

18%

Sales

weight

0.2391

0.2835

0.0433

0.5123

0.2707

-0.0194

-0.0573

revenues

1.0112

-0.1283

Net

13%

assets

weight

0.0596

0.2432

0.6680

1.6131

0.3275

Net

13%

profits

weight

1.0307

0.5038

0.0378

-0.0022 -0.0762

-0.0230 -0.0828

-0.0718

-0.0169 -0.0801

-0.0547

-0.0140 -0.1403

“return on net assets” is: Return on net assets=net profit before tax/ net assets.

8%

assets

Return

weight

on total

0.0377

0.0029

-0.0211

-0.0063

-0.0122

-0.0210

-0.0140

-0.0109

-0.0625

8%

weight

assets

Return

on net

0.0576

0.0169

0.1121

-0.0204

-0.1442

-0.0015

-0.0036

-0.0018

-0.0033

per

5%

Sales

weight

0.0932

0.0293

0.0625

0.0259

0.0045

0.0822

revenues

0.0220

0.0219

0.0783

employee

contribution

6%

weight

0.1166

0.0677

0.0255

0.0851

0.0391

revenue

0.0006

0.1044

0.0085

-0.0150

revenues

The ratio of

to total sales

international

data of the other 3 lists is the sales revenues of the related products in the sub-sectors of the optical communications industry.

14%

weight

0.0001

0.0012

0.0092

-0.0249

0.0149

0.0155

for the last

-0.0532

-0.0016

-0.0354

three years

The average

growth rate of

sales revenues

The weighted standard value indexs of financial datač70% weightĎ

15%

weight

0.0458

0.0085

0.0028

0.0129

-0.1232

-0.0263

-0.0293

-0.0165

-0.1500

for the last

growth rate

three years

The average

of net profits

(A)

of

Total

3.9916

1.9298

0.3113

standard

0.6584

0.6324

-0.2104

-0.4483

weighted

-0.2145

-0.1661

value indexs

financial data

34%

weight

0.2321

0.8021

0.1305

0.6658

0.3651

0.1082

0.2855

0.2573

0.0961

innovation

Technology

18%

weight

0.1271

0.1325

0.2847

0.2490

0.3729

0.5211

0.1350

0.1185

0.3854

Customer

satisfaction

12%

weight

Brand

0.2505

0.1622

0.1561

0.2140

0.2222

0.2297

0.5037

0.1695

0.1672

awareness

11%

weight

level of

0.1180

0.1716

0.2531

0.2953

0.2556

0.1793

0.1405

0.3387

0.5532

enterprise

Management

25%

weight

culture

0.5876

0.1969

0.2890

0.1829

0.2025

0.3022

0.4796

0.1803

0.3589

Corporation

The weighted standard value indexs of survey data(30% weight)

(B)

Total

standard

2.9677

1.3446

0.8050

2.0709

0.7501

weighted

1.6553

0.7398

1.2838

0.8121

value indexs

of survey data

indexs of

1.9721

0.0964

Optical Communications of China & Global Market (2022)

0.9575

0.1087

3.6844

0.6213

0.0718

0.8278

-0.0723

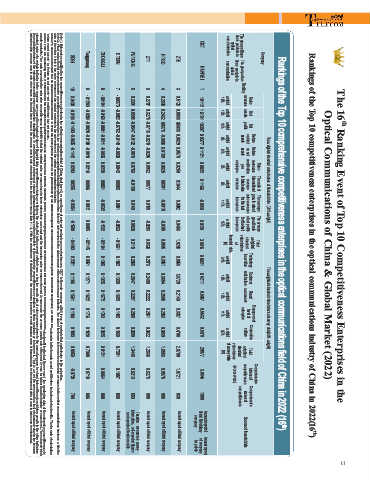

Note 1: Enterprises qualified for the competitiveness selection in the optical communications field of China shall have 2 or more items of relevant products as core businesses. CICT is the only company with 3 types of products that participates in the selection.

$ %

Comprehensive

competitiveness

809

806

939

905

893

799

808

900

1000

scores of

The 16 th Ranking Event of Top 10 Competitiveness Enterprises in the

Comprehensive

competitiveness

company

Rankings of the Top 10 comprehensive competitiveness enterprises in the optical communications field of China in 2022 (16 th )

listed Subsidiary

Annual report of

Rankings of the Top 10 competitiveness enterprises in the optical communications industry of China in 2022(16 th )

indicators (the average growth rate of revenues for the last three years & the average growth rate of net profit for the last three years) within [-1,1]. With the consistency of statistical test, the overdone impact on overall standard value of financial data by the abnormal data of growth index can be eliminated.

Source of financial data

and operators' tender results

Taxationǃresearch ˂ survey

Annual report of listed company

Annual report of listed company

for public

Annual report of listed company

Annual report of listed company

Annual report of listed company

Annual report of listed company

Annual report of listed company

information˗self-reported figures

of company

Annual report

standard value of a certain indicator in the company may cause the standard value of financial data competitiveness index over high on the whole. But in the second or third years, when the growth rate of sales revenues drops to the normal average level and instead there is no higher growth in the other indicators,

the monitoring index of the enterprise competitiveness will decline significantly. To avoid the impact of abnormal change in financial indicators on the objectivity of the enterprise competitiveness evaluation, we find a practical way to improve it. That is, we set the upper and low limit of standard value in the increase

Note 2: What makes the list of comprehensive competitiveness enterprises in the optical communications field different from the other lists of 3 sub-sectors is the data resource of the sales revenues indicator. The data of the former list comes from the total revenues in the optical communications business, while the

Note 4: From the monitoring data, it is found that if the enterprise competitiveness comes mainly from the increase indicators (that is, the average growth rate of revenues for the last three years & the average growth rate of net profit for the last th ree years), the monitoring data of the enterprise competitiveness is

usually unstable. The main reason for the enterprise competitiveness instability is that the original sales revenues base in these enterprises was small and the increasing sales revenues of recent 2 years make the average growth rate of the past 3 years far higher than the industry average level. The extremely high

Note 3: “Return on net assets” can be defined in different formula. To avoid the incomparable problem of net profit caused by the different corporate income tax rate in listed companies and unlisted companies, we define the molecular in the formula as net profit before tax instead of net profits. The formula of calculating

11