Page 16 - Market Analysis Report of Optical Communications Field in China & Global market 2022

P. 16

C H I N A

Source of financial data Annual report of listed company Annual report of listed company Annual report of listed company Annual report of listed parent company Annual report of listed company Annual report of listed company Annual report of listed company Annual report of listed company Annual report of listed company Annual report of listed company

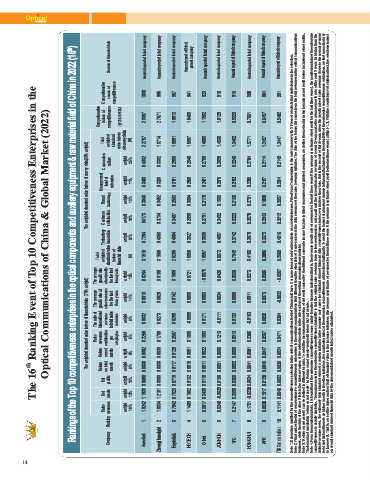

Rankings of the Top 10 competitiveness enterprises in the optical components and auxiliary equipment & raw material field of China in 2022 (16 th )

Comprehensive scores of competitiveness 1000 995 957 941 923 918 915 908 904 901

The 16 th Ranking Event of Top 10 Competitiveness Enterprises in the

Comprehensive indexs of competitiveness $ % 2.8897 2.7671 1.9013 1.5488 1.1592 1.0129 0.9323 0.7661 0.6457 0.5482

Optical Communications of China & Global Market (2022)

Total Corporation weighted culture standard value indexs of survey data weight (B) 25% 2.2787 0.4882 1.8714 0.3382 1.6091 0.2986 1.5097 0.2840 1.4008 0.2780 1.4930 0.2698 1.3462 0.2240 1.5771 0.2784 1.2457 0.2114 1.3447 0.2149

The weighted standard value indexs of survey data(30% weight) Management Brand level of awareness enterprise weight weight 11% 12% 0.3480 0.3048 0.3288 0.3452 0.3101 0.2503 0.2530 0.3004 0.2431 0.2170 0.2979 0.1665 0.2102 0.2156 0.2780 0.2751 0.2127 0.1898 0.2014 0.2057

Technology Customer satisfaction innovation weight weight 18% 34% 0.4173 0.7204 0.3734 0.4858 0.3497 0.4004 0.2896 0.3827 0.2791 0.3835 0.3492 0.4097 0.3222 0.3742 0.3578 0.3878 0.2943 0.3375 0.3212 0.4016 Note 2: What makes the list of comprehensive competitiveness enterprises in the optical communications field different from the other lists of 3 sub-sectors is the data resource of the sales revenues indicator.

Total weighted of net profits standard value indexs of financial data (A) 3.1516 3.1509 2.0266 1.5656 1.0557 0.8072 0.7549 0.4186 0.3886 0.2069 Note 1: Enterprises qualified for the competitiveness selection in the optical communications field of China shall have 2 or more items of relevant products as core businesses. FiberHome Technologies is the only company with 3 types of products that participates in the selection.

The average The average growth rate growth rate of sales revenues for the last for the last three years three years weight weight 15% 14% 0.0244 0.0010 0.0186 0.0029 0.1500 0.0142 0.0721 0.0060 -0.0078 0.0003 0.0428 0.0034 0.0538 0.0080 0.0273 0.0011 0.0506 0.0073 -0.0567 -0.0032

The weighted standard value indexs of financial datač70% weightĎ The ratio of Sales international revenues revenue contribution to total sales per revenues employee weight weight 6% 5% 0.0032 0.2256 0.0273 0.1709 0.0290 0.2507 -0.0099 0.1685 0.0171 0.1063 -0.0111 0.1213 0.0133 0.0513 -0.0153 0.2386 0.0059 0.0567 0.0304 0.0471 business, while the data of the other 3 lists is the sales revenues of the related products in the sub-sect

Net Return Return on net on total profits assets assets weight weight weight 8% 8% 13% 0.0062 0.0036 0.0696 0.0039 0.0030 0.0808 0.0126 0.0117 0.0719 0.0051 0.0015 0.0132 0.0022 0.0011 0.0116 0.0086 0.0051 0.0150 0.0090 0.0092 0.0360 0.0081 0.0041 0.0034 0.0047 0.0049 0.0128 0.0024 0.0030 0.0052 The formula of calculating “return on net assets” is: Return on net assets=net profit before tax/ net assets. on overall st

Net assets weight 13% 1.1938 1.2101 0.7823 0.1682 0.3430 -0.0029 0.3596 -0.0238 0.1517 0.0646

Sales revenues weight 18% 1.6242 1.6334 0.7042 1.1409 0.5817 0.6248 0.2147 0.1751 0.0938 0.1141

Ranking 1 2 3 4 5 6 7 8 9 10

Company Accelink Zhongji Innolight Eoptolink HGTECH O-Net JONHON TFC HONGHUI AFR T&S Communications

14