Page 12 - Market Analysis Report of Optical Communications Field in China & Global market 2022

P. 12

C H I N A

Country 64" 64" 64" $IJOB $IJOB $IJOB +BQBO $IJOB +BQBO +BQBO

Source of financial data Annual report of listed company Annual report of listed company Annual report of listed company Annual report of listed company Annual report of listed company Annual report of listed company Annual report of listed company Annual report of listed company Annual report of listed company Annual report of listed company

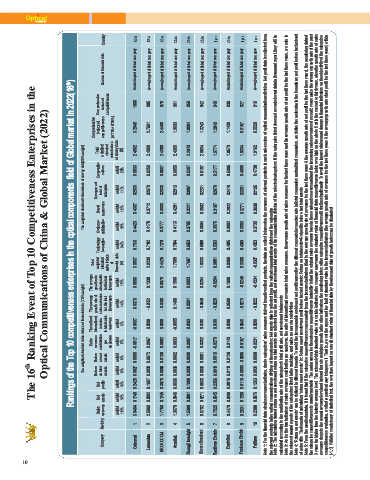

Rankings of the Top 10 competitiveness enterprises in the optical components field of Global market in 2022(16 th )

The 16 th Ranking Event of Top 10 Competitiveness Enterprises in the

Comprehensive scores of competitiveness 1000 985 976 961 959 942 940 936 927 919

Optical Communications of China & Global Market (2022)

Comprehensive Total indexs of weighted competitiveness standard value indexs (A*70%+B*30%) of survey data (B) 3.2545 2.4862 2.7661 2.4000 2.4408 2.4369 1.9693 2.4369 1.8994 2.2043 1.3243 2.0034 1.2849 1.9774 1.1430 1.8573 0.8157 1.9334 0.5520 1.9162

The weighted standard value indexs of survey data(30% weight) Management Corporation Brand level of culture awareness enterprise weight weight weight 25% 11% 12% 0.5833 0.2933 0.4357 0.6250 0.2679 0.3712 0.6587 0.2838 0.3888 0.6059 0.2913 0.4281 0.5297 0.3087 0.3221 0.5197 0.2231 0.3502 0.5177 0.2070 0.3187 0.5365 0.2418 0.2922 0.4008 0.3351 0.3771 0.4738 0.2135 0.3630

Technology Customer satisfaction innovation weight weight 18% 34% 0.4423 0.7316 0.4178 0.7182 0.3777 0.7279 0.4113 0.7004 0.3785 0.6653 0.3504 0.5599 0.3976 0.5363 0.3062 0.4805 0.3853 0.4350 0.3735 0.4923 Note 1: For the financial data of sales revenues indicator, due to enterprises’ sales revenues derived from diversified products, the data we collect is based on the revenues of relevant products in each sub-secto

Total weighted standard value indexs of financial data (A) 3.5837 2.9230 2.4425 1.7689 1.7687 1.0333 0.9881 0.8369 0.3366 -0.0327

The average The average growth rate growth rate of of net profits sales revenues for the last for the last three years three years weight weight 15% 14% 0.0856 0.0376 0.1338 -0.0152 0.0070 -0.0160 0.1500 0.1400 0.0003 0.0001 0.0284 -0.0049 -0.0204 -0.0220 0.1608 0.0599 -0.0245 -0.0273 -0.4234 -0.0222

The weighted standard value indexs of financial datač70% weightĎ The ratio of Sales international revenues revenue contribution to total sales per revenues employee weight weight 6% 5% -0.0037 -0.0017 0.0298 0.0067 0.0306 0.0992 -0.0055 0.0033 0.0263 -0.0007 0.0108 0.0382 0.0130 -0.0279 0.0286 0.0143 0.0048 -0.0157 0.0200 -0.0231 the relevant products in the optical communications division of the enterprise; Net assets data is colle

Net Return Return on net on total profits assets assets weight weight weight 8% 8% 13% 0.0055 0.0027 0.2425 0.0072 0.0029 0.1607 0.0189 0.0056 0.3978 0.0062 0.0036 0.0696 0.0039 0.0030 0.1098 0.0061 0.0038 0.0538 0.0019 0.0010 0.2356 0.0126 0.0110 0.0819 -0.0005 -0.0008 0.0110 0.0098 0.0034 0.1263 calculated according to the contribution rate of the enterprise’s total profit rate, net assets and total assets. the relea

Net assets weight 13% 0.1748 0.0902 0.1245 0.0346 0.0861 0.0271 0.0545 0.0209 0.1266 0.0376

Sales revenues weight 18% 3.0404 2.5069 1.7750 1.3670 1.5398 0.8702 0.7525 0.4470 0.2631 0.2388

Ranking 1 2 3 4 5 6 7 8 9 10

Company Coherent Lumentum BROADCOM Accelink Zhongji Innolight Hisense Broadband Sumitomo Electric Eoptolink Furukawa Electric Fujikura

10