Page 23 - Market Analysis Report of Optical Communications Field in China & Global market 2015

P. 23

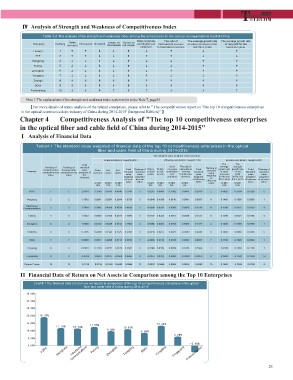

Table 3-2 The analysis of the strength and weakness index among the enterprises in the optical communications field of China

Company Ranking Sales Net assets Net profit Return on Return on Sales revenues The ratio of The average growth rate The average growth rate

Huawei revenues total assets net assets contribution per international revenue of sales revenues for the of net profit for the

to total sales revenues last three years

employee last three years

ĭ

1ĭ ĭ į į ĭ į ĭ į

ZTE 3ĭ ĭ į į ĭ ĭ ĭ į į

Hengtong 4į į į į ĭ į į ĭ ĭ

Futong 5į į į į ĭ į į ĭ ĭ

Zhongtian 6į į į į ĭ į ĭ ĭ ĭ

Yongding 7į į į į ĭ ĭ į į ĭ

Zhongli 8į į į į ĭ ĭ ĭ ĭ ĭ

SDGI 9į į į į ĭ į į ĭ ĭ

Fuchunjiang 10 į į į ĭ ĭ ĭ į į ĭ

Table4-1 The standard value weighted of financial data of the top 10 competitiveness enterprises in the optical

fiber and cable field of China during 2014-2015

The standard value weighted of financial data

Scale sub-factors˄weight 44%˅ Efficiency sub-factors˄weight 27%˅ Increase sub-factors˄weight 29%˅

Total The The

Ranking of Ranking of standard Sales The ratio of Ranking of average average

revenues standard

comprehensive financial data value Sales Net Net Total Ranking of Return Return contribution international Total growth rate growth rate Total Ranking of

revenues assets profit on net value standard standard

Company competitiveness competitiveness weighted of standard standard on total assets per revenue standard weighted of sales of net

weight employee value value

index index the 13% value value assets weight to total sales value of revenues profit weighted weighted

8% weight efficiency of increase of increase

financial weighted weighted revenues weighted for the last for the last

index index index

of scale of scale of efficiency three years three years

weight weight index index weight weight index weight weight

14% 15%

18% 13% 8% 5% 6%

YOFC 1 1 2.0981 1.1186 0.1693 0.4140 1.7019 1 0.0235 0.0666 0.1042 0.0093 0.2036 2 0.0426 0.1500 0.1926 5

Hengtong 2 2 1.7563 0.8891 0.2591 0.2244 1.3726 3 -0.0040 0.0306 0.0610 0.0061 0.0937 6 0.1400 0.1500 0.2900 1

3

FiberHome 4 3 1.7434 0.5401 0.4189 0.4578 1.4168 2 -0.0008 0.0282 0.0309 0.0653 0.1236 4 0.1208 0.0822 0.2030 4

Communications

5 1.4023 0.8000 0.1609 0.2197 1.1806 5 0.0116 0.0325 0.0641 0.0039 0.1121 5 0.1095 0.0001 0.1096 8

Futong

Zhongtian 5 4 1.6255 0.6122 0.3249 0.2613 1.1984 4 0.0086 0.0202 0.0703 0.0380 0.1371 3 0.1400 0.1500 0.2900 1

Tongding 6 6 0.7095 0.2888 0.1123 0.1375 0.5386 6 -0.0010 0.0257 0.0079 -0.0083 0.0243 8 0.1400 0.0066 0.1466 6

SDGI 7 7 0.5836 0.2211 0.0295 0.0143 0.2649 7 -0.0062 0.0149 0.0106 0.0094 0.0287 7 0.1400 0.1500 0.2900 1

Yongding 8 8 0.5826 0.1139 0.0771 -0.0218 0.1692 8 0.0188 0.0359 0.0959 0.1478 0.2984 1 -0.0350 0.1500 0.1150 7

Tongguang 9 9 -0.0639 0.0645 0.0077 -0.0056 0.0666 9 -0.0054 0.0012 0.0068 -0.0099 -0.0073 9 0.0268 -0.1500 -0.1232 12

Potevio Fasten 10 12 -0.1126 -0.0314 -0.0148 -0.0482 -0.0944 12 -0.0357 -0.0448 0.0089 0.0634 -0.0082 10 0.1400 -0.1500 -0.0100 9

Chart4-1 The financial data of return on net assets in comparison of the top 10 competitiveness enterprises in the optical

fiber and cable field of China during 2014-2015

YOFC Hengtong CFiobmermHuonmiceations Futong Zhongtian Tongding SDGI Yongding Tongguang

Potevio Fasten