Page 44 - 2023年光通信竞争力报告(摘要版)

P. 44

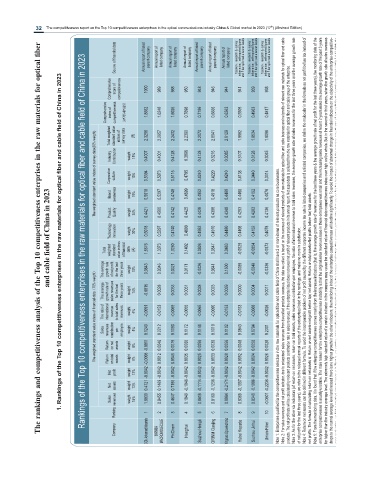

32 The competitiveness report on the Top 10 competitiveness enterprises in the optical communications industry China & Global market in 2023 (17 ) (Abstract Edition)

th

Source of financial data Annual report of listed parent company Annual report of listed company Annual report of listed company Annual report of listed company Annual report of listed parent company Annual report of listed parent company Annual report of listed company Taxationǃresearch ˂ survey information˗self-reported figures and Fiber optic cable tender results Taxationǃresearch ˂ survey information˗self-reported figures and Fiber optic

Comprehensive score of competitiveness 1000 989 988 950 948 946 944 941 939 938

Comprehensive Total weighted index of standard value competitiveness indexs of survey data $ % (B) 1.8662 2.3296 1.6248 2.2957 1.6026 2.2432 0.7698 2.2390 0.7199 2.2070 0.6666 2.0941 0.6363 2.0129 0.5505 1.9582 0.4963 1.8534 0.4817 1.8096

The weighted standard value indexs of survey data(30% weight) Corporation Industry Brand culture Contribution awareness weight weight weight 15% 15% 10% 0.4007 0.5394 0.5018 0.4001 0.5073 0.5297 0.4128 0.5115 0.4740 0.3896 0.4795 0.4699 0.4128 0.4240 0.4952 0.3216 0.4220 0.4910 0.3085 0.4240 0.4480 0.3107 0.4138 0.4408 0.3128 0.3440 0.4152 0.3045 0.3314 0.4078

and cable field of China in 2023 The rankings and competitiveness analysis of the Top 10 competitiveness enterprises in the raw materials for optical fiber 1. Rankings of the Top 10 competitiveness enterprises in the raw materials for optical fiber and cable field of China in 2023 Rankings of the Top 10 competitiveness enterprises in the raw materials for optical fiber and cable field of China in 2023 The average Total growth rate weighted Product Technology of net

The weighted standard value indexs of financial datač70% weightĎ The average The ratio of Sales growth rate of international revenues sales revenues revenue contribution for the last to total sales per three years revenues employee weight weight weight 14% 6% 5% -0.0015 -0.0091 0.1240 0.0028 -0.0153 0.2212 0.0053 -0.0069 0.1090 0.0051 -0.0055 0.1172 0.0028 -0.0065 0.1144 0.0023 -0.0090 0.1019 0.0059 -0.0153 0.1102 0.0

Net Return Return on net on total profit assets assets weight weight weight 8% 8% 13% -0.0011 -0.0008 -0.0042 0.0046 0.0012 -0.0042 0.0079 0.0046 -0.0042 0.0066 0.0035 -0.1046 -0.0042 0.0056 0.0025 -0.1114 -0.0042 0.0030 0.0033 -0.1236 -0.0042 0.0056 0.0028 -0.2171 -0.0042 0.0048 0.0052 -0.1557 -0.0042 0.0050 0.0024 -0.1908 -0.0042 0.0028 0.0026 -0.2236 -0.0042

Net assets weight 13% 0.4721 0.1469 0.7156

Sales revenues weight 18% 1.0039 0.9455 0.4647 0.1049 0.0819 0.0169 0.0084 0.0369 0.0340 -0.0601

Ranking 1 2 3 4 5 6 7 8 9 10

Company CGN Advanced Materials WANMA MACROMOLECULE PhiChem Honghui Suzhou Hengli GRINM Guojing Yingmao Optoelectronic Hubei Kepuda Suzhou Jinhui Union-Fiber