Page 40 - 2023年光通信竞争力报告(摘要版)

P. 40

28 The competitiveness report on the Top 10 competitiveness enterprises in the optical communications industry China & Global market in 2023 (17 ) (Abstract Edition)

th

The 17 th Ranking Event of Top 10 Competitiveness Enessenterprises in the Optical Communications of China & Global Market (2023)

Country China Finland Sweden China USA China Japan Germany Japan USA

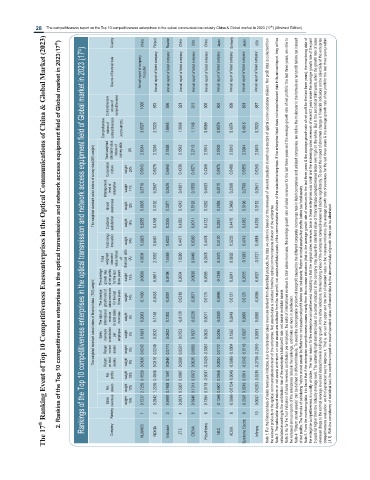

2. Rankins of the Top 10 competitiveness enterprises in the optical transmission and network access equipment field of Global market in 2023(17 th )

Rankings of the Top 10 competitiveness enterprises in the optical transmission and network access equipment field of Global market in 2023 (17 th )

Source of financial data Annual report of company for public Annual report of listed company Annual report of listed company Annual report of listed company Annual report of listed company Annual report of listed company Annual report of listed company Annual report of listed company Annual report of listed company Annual report of listed company

Comprehensive scores of competitiveness 1000 953 936 921 913 905 904 899 891 887

Comprehensive Total weighted indexs of standard value competitiveness indexs of survey data $ % (B) 3.6527 2.8344 2.3320 2.3246 1.8065 2.1836 1.3868 2.1542 1.1146 2.2113 0.8589 2.1914 0.8579 2.0500 0.6874 2.0810 0.4618 2.0044 0.3520 2.0415

The weighted standard value indexs of survey data(30% weight) Management Corporation Brand level of culture awareness enterprise weight weight weight 25% 11% 12% 0.5843 0.3718 0.6605 0.5579 0.2907 0.4192 0.6068 0.3629 0.3071 0.4239 0.4301 0.4242 0.4571 0.1959 0.5192 0.4369 0.4683 0.4262 0.5978 0.3515 0.2956 0.5489 0.2208 0.3468 0.5055 0.2789 0.3196 0.5265 0.2841 0.3152

Technology Customer satisfaction innovation weight weight 18% 34% 0.6255 0.5923 0.4108 0.6461 0.3045 0.6022 0.4282 0.4477 0.4011 0.6380 0.4122 0.4478 0.2931 0.5120 0.4410 0.5235 0.4262 0.4742 0.4339 0.4818 Note 1: For the financial data of sales revenues indicator, due to enterprises’ sales revenues derived from diversified products, the data we collect is based on the revenues of relevant products in each sub-s

Total weighted standard value indexs of financial data (A) 4.0034 2.3352 1.6449 1.0580 0.6446 0.2878 0.3470 0.0902 -0.1993 -0.3721

The average The average growth rate growth rate of of net profits sales revenues for the last for the last three years three years weight weight 15% 14% -0.0009 -0.1400 0.0811 -0.0453 0.0708 -0.0091 0.0034 0.0310 -0.0008 -0.0671 0.0093 0.0175 -0.1398 -0.0996 0.0241 0.0131 0.0035 0.0125 0.0027 -0.0099

The weighted standard value indexs of financial datač70% weightĎ The ratio of Sales international revenues revenue contribution to total sales per revenues employee weight weight 6% 5% 0.0063 0.1961 0.1148 0.2032 0.1200 0.0803 -0.0130 0.0753 -0.0228 0.1937 0.0071 0.0925 -0.0300 0.0495 0.0249 0.1562 0.0660 -0.0027 0.0290 0.2081 the relevant products in the optical communications division of the enterprise; Net assets data is coll

Net Return Return on net on total profits assets assets weight weight weight 8% 8% 13% 0.0242 0.0126 0.4559 0.0249 0.0318 0.4046 0.0774 0.0846 0.1591 0.0501 0.0268 0.0987 0.0065 0.0020 0.0072 -0.0057 -0.0420 -0.0011 0.0172 0.0004 0.0958 -0.0004 -0.0080 -0.0116 -0.0342 0.0014 -0.2910 -0.2700 -0.0203 -0.0215 calculated according to the contribution rate of the enterprise’s total profit rate, net assets and total assets.

Net assets weight 13% 2.7255 1.2259 0.7928 0.5037 0.1314 0.0718 0.5901 -0.0996 -0.0154 -0.0046 0.0249

Sales revenues weight 18% 0.7237 0.2942 0.2689 0.2821 0.3946 0.1384 -0.1366 -0.2591 0.0007

Ranking 1 2 3 4 5 6 7 8 9 10

Company HUAWEI NOKIA Ericsson ZTE CIENA FiberHome NEC ADVA Sumitomo Electric Infinera