Page 26 - 2022年光通信竞争力报告(摘要版)

P. 26

14 The competitiveness report on the Top 10 competitiveness enterprises in the optical communications industry China & Global market in 2022 (16 ) (Abstract Edition)

th

The 16 th Ranking Event of Top 10 Competitiveness Enterprises in the Optical Communications of China & Global Market (2022)

Source of financial data Annual report of company for public Annual report of listed company Annual report of listed company Annual report of listed company Taxationǃresearch ˂ survey information˗self-reported figures and operators' tender results Annual report of listed company Taxationǃresearch ˂ survey information˗self-reported figures and operators' tender results Annual report of listed company Taxationǃresearch ˂ survey information˗

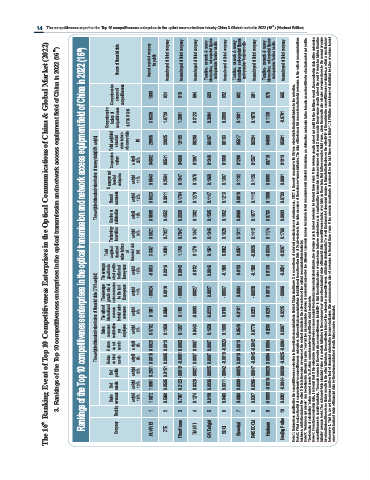

3. Rankings of the Top 10 competitiveness enterprises in the optical transmission and network access equipment field of China in 2022 (16 th )

Rankings of the Top 10 competitiveness enterprises in the optical transmission and network access equipment field of China in 2022 (16 th )

Comprehensive scores of competitiveness 1000 924 910 694 693 692 682 681 675 665

Comprehensive Total weighted indexs of standard competitiveness value indexs of survey data $ % (B) 3.5839 2.9985 1.9720 2.3025 1.3981 1.9195 0.3123 0.6260 0.3084 0.6407 0.3058 0.8183 0.1901 0.5517 0.1870 0.6294 0.1136 0.4566 -0.0781 0.5091

The weighted standard value indexs of survey data(30% weight) Management Corporation Brand level of culture awareness enterprise weight weight weight 25% 11% 12% 0.4002 0.5543 0.5823 0.5541 0.2594 0.3011 0.4068 0.1947 0.1764 0.1097 0.1075 0.1279 0.1349 0.1060 0.1147 0.1880 0.1387 0.1213 0.1288 0.1132 0.0919 0.1567 0.1126 0.1112 0.0716 0.0968 0.1006 0.1013 0.0681 0.0733

Technology Customer satisfaction innovation weight weight 18% 34% 0.6596 0.8021 0.4552 0.7327 0.3569 0.7847 0.1362 0.1447 0.1505 0.1346 0.1882 0.1820 0.0868 0.1311 0.1077 0.1412 0.0703 0.1174 0.0903 0.1760 Note 2: What makes the list of comprehensive competitiveness enterprises in the optical communications field different from the other lists of 3 sub-sectors is the data resource of the sales revenues indicato

Total weighted standard value indexs of financial data (A) 3.8347 1.8304 1.1746 0.1779 0.1661 0.0862 0.0351 -0.0026 -0.0334 -0.3297

The average The average growth rate growth rate of of net profits sales revenues for the last for the last three years three years weight weight 15% 14% -0.0013 -0.0024 0.0316 0.0018 0.0045 -0.0003 -0.0132 -0.0027 0.0046 0.0027 -0.1500 -0.0037 -0.0140 0.0064 -0.1500 -0.0028 0.0189 0.0018 -0.3524 -0.0096 Note 1: Enterprises qualified for the competitiveness selection in the optical communications field of China shall have 2 or

The weighted standard value indexs of financial datač70% weightĎ The ratio of Sales international revenues revenue contribution to total sales per revenues employee weight weight 6% 5% 0.1091 0.3702 0.0969 0.1358 0.1105 0.1397 -0.0093 0.0443 -0.0223 0.1658 0.0180 0.1500 -0.0181 0.0540 0.0223 0.0779 -0.0201 -0.0208 -0.0225 0.0397 business, while the data of the other 3 lists is the sales revenues of the related products in the su

Net Return Return on net on total profits assets assets weight weight weight 8% 8% 13% 0.0023 0.0015 0.2931 0.0013 0.0005 0.0151 0.0002 -0.0001 -0.0019 0.0007 0.0007 -0.0021 0.0007 0.0007 -0.0025 -0.0023 -0.0015 -0.0042 0.0013 0.0010 -0.0025 -0.0042 -0.0045 -0.0047 0.0004 0.0004 -0.0016 -0.0026 -0.0084 -0.0025 -0.0044 -0.0030 The formula of calculating “return on net assets” is: Return on net assets=net profit befo

Net assets weight 13% 1.9951 0.9505 0.2123 0.0320 0.0036 0.0311 0.0000 0.0286

Sales revenues weight 18% 1.0672 0.5969 0.7097 0.1274 0.0128 0.0488 0.0069 0.0347 -0.0098 0.0332

Ranking 1 2 3 4 5 6 7 8 9 10

Company HUAWEI ZTE FiberHome TIANYI GW Delight SDGI Shanshui RAISECOM Huahuan Nanjing Putian