Page 12 - Market Analysis Report of Optical Communications Field in China & Global market 2016

P. 12

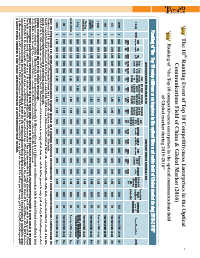

12 The 10th Ranking Event of Top 10 Competitiveness Enterprises in the Optical

Communications Field of China & Global Market (2016)

Ranking of "the Top 10 competitiveness enterprises in the optical communications field

of China during 2015-2016"

Ranking of "the Top 10 competitiveness enterprises in the optical communications field of China during 2015-2016"

Standard value weighted of the financial data(70% weight) Standard value weighted of the survey data(30% weight)

Company Sales The ratio of The average The average Total

revenues international growth rate of growth rate standard

Sales Net Net Return Return contribution revenue sales revenues of net profit value Technology Customer Brand Management Corporation Total standard Comprehensive

profit on total on net for the last weighted of innovation satisfaction awareness level of culture value weighted index of Comprehensive

The group of three The group of two Ranking revenues assets assets assets per to total sales for the last three years the financial enterprise Source of financial data

weight employee revenues three years weight weight weight of the survey competitiveness score of

items products in items products in weight weight weight data weight competitiveness

optical optical weight weight weight $ data

weight % $

%

communication communication weight weight

18% 13% 13% 8% 8% 5% 6% 14% 15% 34% 18% 12% 11% 25%

FiberHome Huawei 1 1.4460 0.5089 0.4668 0.0362 0.1513 0.1295 0.0283 0.1400 0.1500 3.0569 0.7246 0.5224 0.2579 0.2604 0.4435 2.2088 2.8025 Annual report of Annual report

Technologies 1000 listed Subsidiary of company

company for public

ZTE 3 0.6312 0.1966 0.0987 -0.0050 0.0476 0.0343 -0.0113 -0.1400 0.1500 1.0020 0.6688 0.3767 0.2170 0.1631 0.4834 1.9090 1.2741 933 Annual report of listed company

HTGD 4 0.2727 0.0210 -0.0056 0.0041 0.0632 0.0707 -0.1623 0.1400 0.1500 0.5538 0.2462 0.3266 0.2516 0.2731 0.3007 1.3982 0.8071 827 Annual report of listed company

Futong 5 0.2250 0.0105 -0.0078 0.0093 0.0289 0.1093 -0.1830 0.1400 0.1500 0.4821 0.3121 0.2716 0.2257 0.2614 0.3128 1.3836 0.7525

ZTT 6 0.1463 0.0099 -0.0074 0.0169 0.0338 0.1151 -0.1241 0.1400 0.1500 0.4804 0.2591 0.2397 0.2592 0.2532 0.3030 1.3142 0.7306 Taxationǃresearch ˂ survey

824 information˗self-reported figures

and operators' tender results

822 Annual report of listed company

SDGI 7 0.0377 -0.0188 -0.0118 -0.0072 0.0160 -0.0067 -0.1645 0.0081 0.1500 0.0027 0.2557 0.1354 0.1768 0.1332 0.1999 0.9010 0.2722 765 Annual report of listed company

Zhongli 8 -0.2904 0.0202 -0.0081 -0.0077 0.0467 0.0849 -0.1332 0.1400 0.1500 0.0025 0.1486 0.1429 0.1781 0.1878 0.2373 0.8947 0.2702 764 Annual report of listed company

Yongding 9 -0.2750 -0.0105 -0.0107 0.0101 0.0243 0.1403 -0.1790 -0.0361 0.1500 -0.1865 0.1297 0.1570 0.1910 0.1618 0.2190 0.8585 0.1270 730 Annual report of listed company

Fuchunjiang 10 -0.2732 -0.0300 -0.0123 0.0094 0.0266 0.0830 -0.1737 0.0280 0.1433 -0.1989 0.1121 0.1437 0.1781 0.1875 0.1996 0.8210 0.1071 Taxationǃresearch ˂ survey

727 information˗self-reported figures

and operators' tender results

Note 1: Enterprises qualified for the competitiveness selection in the optical communications field of China shall have 2 or more items of relevant products as core businesses. FiberHome Technologies is the only company with 3 types of products that participates in the selection.

Note 2: What makes the list of comprehensive competitiveness enterprises in the optical communications field different from the other lists of 3 sub-sectors is the data resource of the sales revenues indicator. The data of the former list comes from the total revenues in the optical communications business, while the

data of the other 3 lists is the sales revenues of the related products in the sub-sectors of the optical communications industry.

Note 3: “Return on net assets” can be defined in different formula. To avoid the incomparable problem of net profit caused by the different corporate income tax rate in listed companies and unlisted companies, we define the molecular in the formula as net profit before tax instead of net profits. The formula of calculating

“return on net assets” is: Return on net assets=net profit before tax/ net assets.

Note 4: From the monitoring data, it is found that if the enterprise competitiveness comes mainly from the increase indicators (that is, the average growth rate of revenues for the last three years & the average growth rate of net profit for the last th ree years), the monitoring data of the enterprise competitiveness is

usually unstable. The main reason for the enterprise competitiveness instability is that the original sales revenues base in these enterprises was small and the increasing sales revenues of recent 2 years make the average growth rate of the past 3 years far higher than the industry average level. The extremely high

standard value of a certain indicator in the company may cause the standard value of financial data competitiveness index over high on the whole. But in the second or third years, when the growth rate of sales revenues drops to the normal average level and instead there is no higher growth in the other indicators,

the monitoring index of the enterprise competitiveness will decline significantly. To avoid the impact of abnormal change in financial indicators on the objectivity of the enterprise competitiveness evaluation, we find a practical way to improve it. That is, we set the upper and low limit of standard value in the increase

indicators (the average growth rate of revenues for the last three years & the average growth rate of net profit for the last three years) within [-1,1]. With the consistency of statistical test, the overdone impact on overall standard value of financial data by the abnormal data of growth index can be eliminated.