Preface • Work summaryIn 2021, global optical communications market has gradually stabilized and rebounded with the world entering into a phase of normalized prevention and control, economy slowly recovering and countries speeding up investment in their communication network infrastructure and introducing favorable policies. According to statistics, more than 160 operators have launched 5G services and 5G subscribers has also significantly increased, which is expected to exceed 500 million by the end of this year. As 5G development accelerates, the global demand for optical fiber and cable has increased substantially. In the first half of 2021, the total amount of global optical fiber and cable increased by 11.1% compared with that in the same period of last year, which is estimated to exceed over 600 million in 2025.

In the optical transmission and network access equipment, we find that its potential is being gradually released as large-scale procurement of optical communication equipment by operators has injected driving force to the industry. In accordance with the Rankings of the Top 10 competitiveness enterprises in the optical transmission and network access equipment of global market in 2021 (15th), the top 10 companies are respectively from Sweden (Ericsson), Finland (Nokia), Japan (NEC), the United States (CIENA, Infinera and ADTRAN), China (Huawei, ZTE, FiberHome) and Germany (ADVA). Among them, Huawei firmly occupies the first place with its global market share of 18.27%, CIENA the second with 13.35%, Ericsson the third with 13.10%, Nokia the fourth with 10.93%, FiberHome the fifth with 10.42% and ZTE the sixth with 8.81%. Infinera, NEC, ADVA and ADTRAN come after with the market share of 7.10%, 3.72%, 3.64% and 2.66% respectively.

Optical component industry has been increasingly concentrated with enterprises accelerating their mergers and acquisitions. The market scale of optical component industry has been greatly expanded in recent years from several billions to the current 60 million for the stimulation of global traffic upgrades, which has driven the development of the whole optical communications industry. The industry has become a veritable “dark horse” in the field of optical communications industry. According to the Rankings of the Top 10 competitiveness enterprises in the optical components field of Global market in 2021 (15th), Lumentum takes the first place with a market share of 15.16%, II-VI, Broadcom, Innolight and Accelink follows closely with 14.47%, 11.88%, 9.33%, 8.67% respectively. Sumitomo, Hisense, Furukawa, Fujikura and Eoptolink account for 7.25%, 6.73%, 4.99%, and 2.86%.

Sound Momentum of China’s Optical Fiber and Cable Field

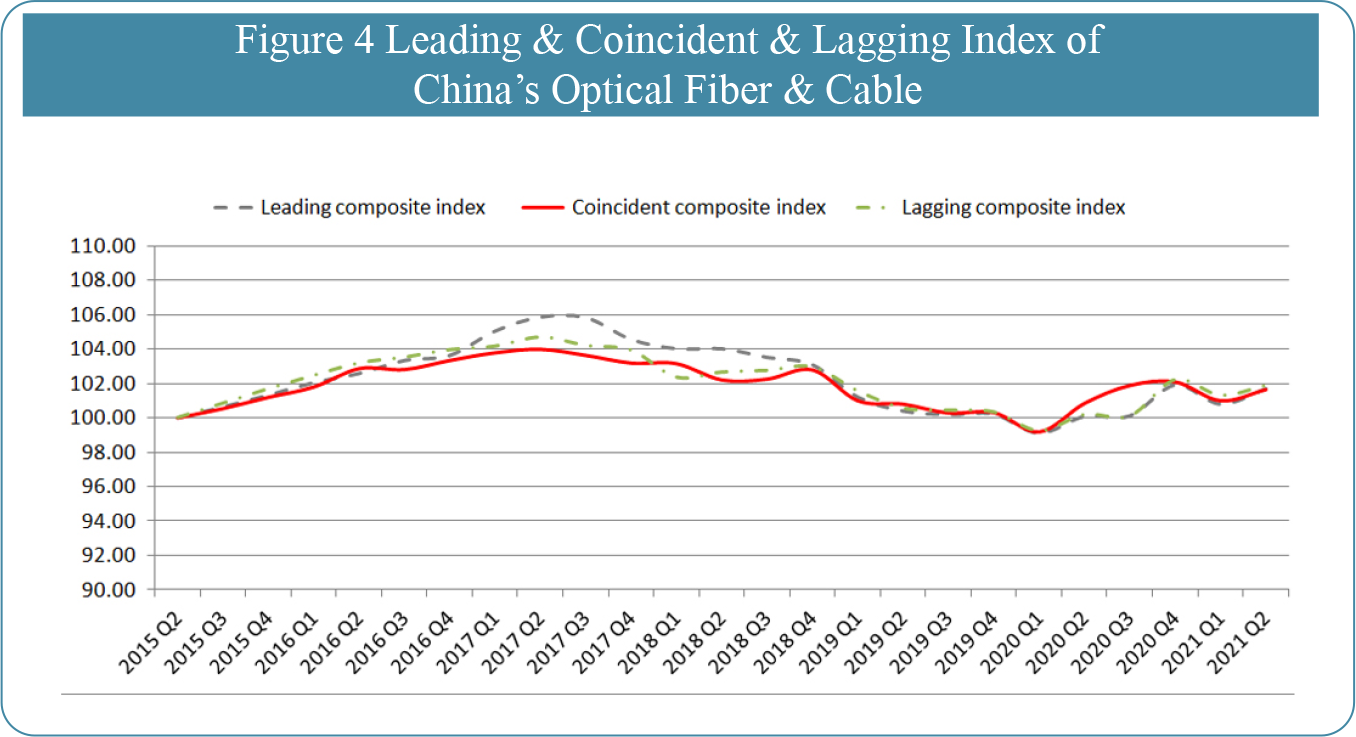

In accordance with the prosperity index of China’s optical fiber and cable industry in 2021, the index has experienced from rapid rise to stable fluctuation, which is in line with the fact that China’ optical fiber and cable industry has undergone three growth periods from outbreak to maturity and then to transformation and adjustment in the past six years. The consensus index showing the prosperity of the industry from 2015 to 2020 are 100, 103.35, 103.2, 102.8, 100.3 and 102.1 respectively with the growth rate slowing down year by year. By stages, from 2015 to 2017, the industry prosperity index increased rapidly, indicating that China's optical fiber and cable industry was in rapid expansion; from 2018 to 2020, the growth rate of the industry declined; in the first quarter of 2020, the industry prosperity index first slowed down for more macroeconomic pressure from covid-19. From the third quarter of 2020 to the second quarter of 2021, with the stabilization and recovery of China's economy, the consensus index reflecting the current prosperity of the industry was 102.1, up 1.8 points month on month.

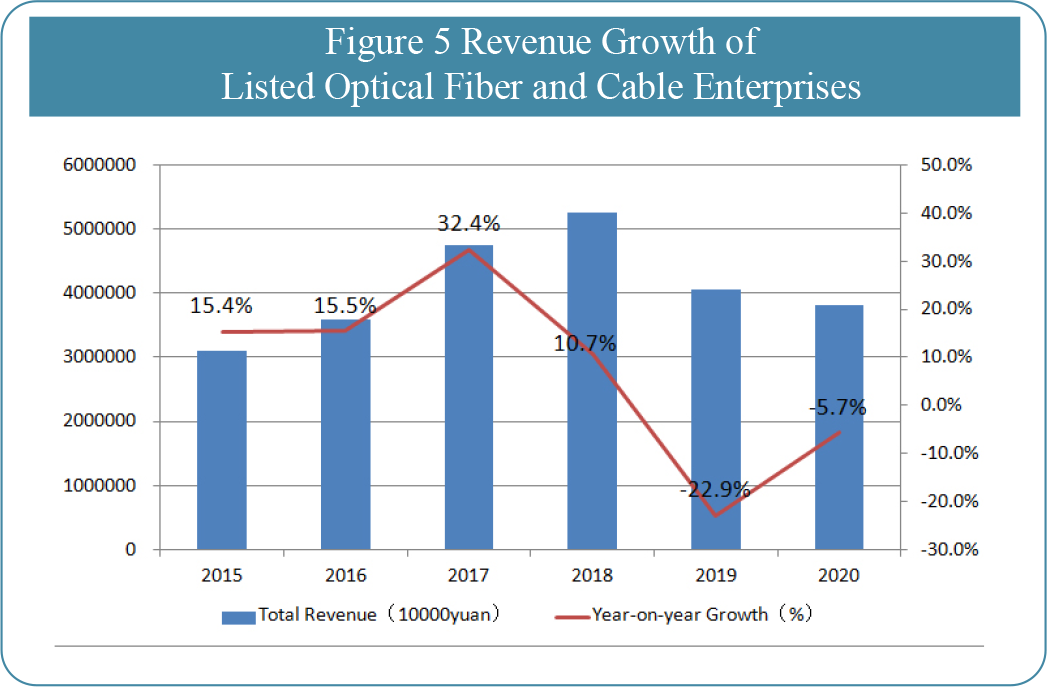

Besides, with the continuous impact of the epidemic and increased demand for consumption and entertainment, the demand for optical fiber and cable in China has been increasing. From 2015 to 2020, the number of netizens in China was close to 1 billion, and the penetration rate reached to 70.4%, displaying that the industry revenue and the growth rate of users shown a trend of slowing down year by year from high-speed growth and short-term fall to a stable and rising stage. Against such industry background, the revenue of China’s optical fiber and cable market kept growing with the revenue in 2020 reaching 37.5 billion yuan (see Figure 5). However, affected by the increasing downward pressure on the macro economy and the combined impact from macroeconomic environmental factors at home and abroad, the growth rate of the industry decreased from 15.4% in 2015 to - 5.7%, with an average annual growth rate of nearly 7.5 percentage points. It is predicted that China's optical fiber and cable industry will enter a period of steady growth (see Figure 6).

Finally, all the members of the review team of “Network Telecom” and “Annual Ranking Event of Top 10 Competitiveness Enterprises in the Optical Communications of China & Global Market” would like to express heartfelt gratitude for the participation and cooperation from the industry colleagues over the past 15 years!

|

Rankings of The Top 10 Competitiveness Enterprises in the Optical Communications Industry of Global & China market in 2021 (15th) |

|||||||||

|